does ca have estate tax

As long as the estate in question does not have assets exceeding 1170 million for 2021 or 1206 million in 2022 you are most likely not on the hook for federal estate or. California does not impose an estate tax but the federal government does.

An Illustrated Guide To The Revocable Trust In California Talbot Law Group P C

California Estate Tax The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California.

. There are no state-level estate taxes. Estate taxAs the grantor or bequeather paying estate taxes is your responsibility not the heirs or beneficiaries. Previous Years California has no specific capital gains tax rates but imposes the regular California income tax.

So I Have To Pay Capital Gains Taxes. 074 of home value. For one thing capital gains tax applies only to 50 of the.

Any gain over 500000 is taxable. The state of California does not impose an inheritance tax. Wealthy Californians Are Subject to the Federal Estate Tax The federal estate tax despite perennial calls by some political groups for its repeal is still in place although who is.

California does have a state sales tax which can range from approximately 7 to 10. Capital gains taxes are not as bad as they might sound. Tax amount varies by county.

What Does That Mean. The median property tax in California is 283900 per year for a home worth the median value of 38420000. The governing withholding laws California Code of Regulations Title 18 Sections 18662-0 through 18662-6 and Section 18662-8 were revised and were effective as of November.

After someone passes away the only tax imposed on his or her California state will be a federal estate tax. But local assessments can be a. California estates must follow the federal estate tax which taxes certain large estates.

Does California Have an Estate Tax. The base tax rate is one of the highest in the country. As of this time in 2022 California does not have its own state-level death tax or estate tax and has not had one since 1982 when it was repealed by.

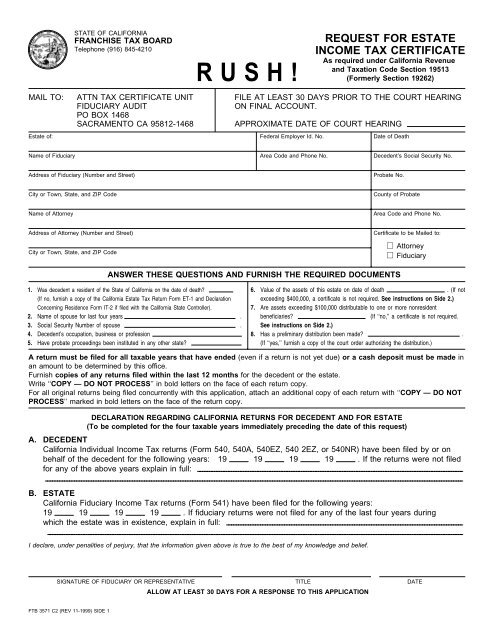

A California Estate Tax Return Form ET-1 is required to be filed with the State Controllers Office whenever a federal estate tax return Form-706 is filed with the Internal Revenue Service IRS. California residents dont need to worry about a state inheritance or estate tax as its 0. It does not matter how large or small your estate is what types of assets you control how many heirs you have or what estate planning.

2022 California Capital Gains Rate vs.

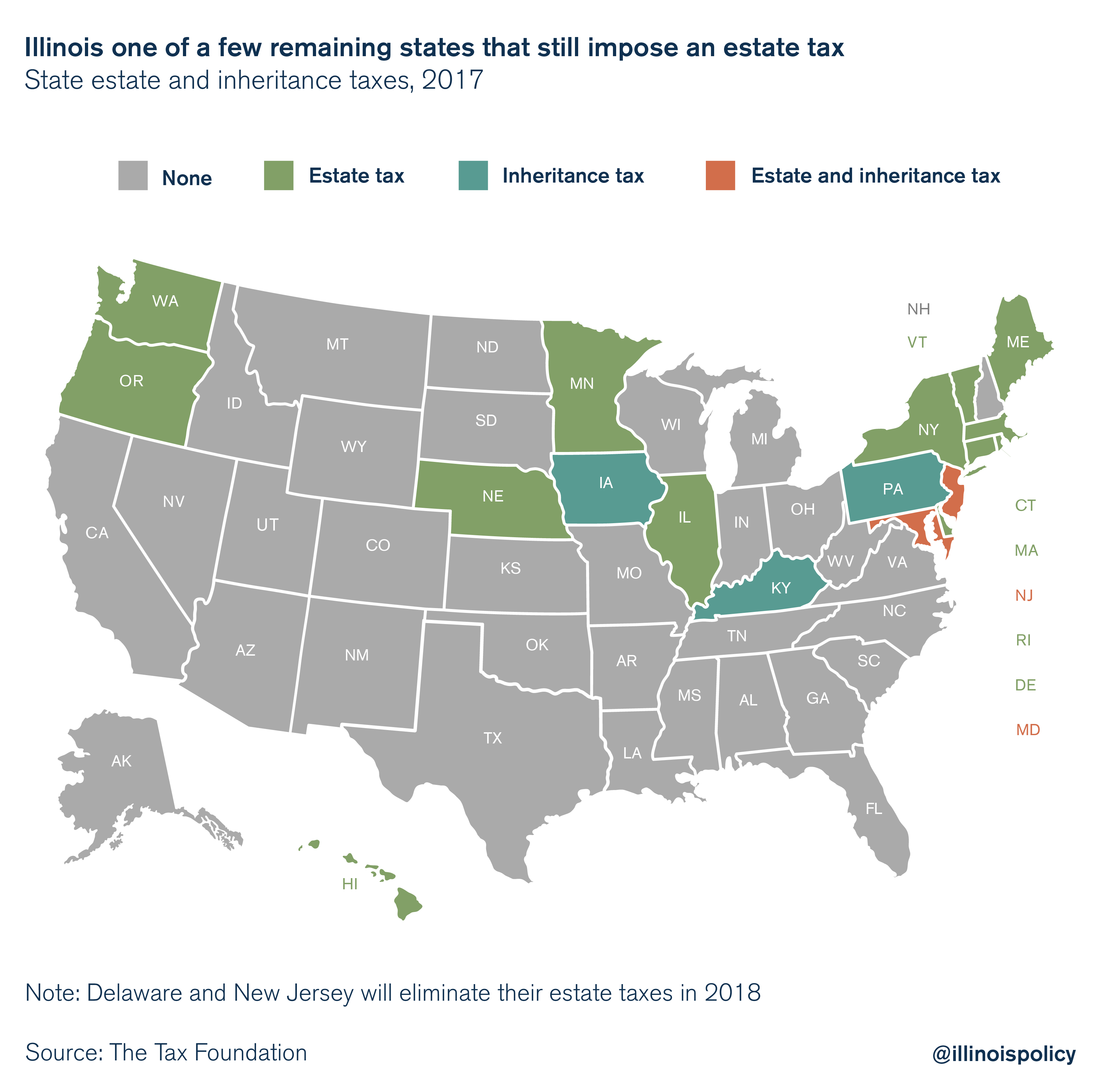

As Other States Repeal Illinois Death Tax Remains

Repeal Of The Estate Tax Would Reduce Federal Resources While Key Public Services Are On The Chopping Block California Budget And Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Publications Research Amp Commentary New California Estate Tax Would Be Huge Burden On An Already Overtaxed State Heartland Institute

1999 Request For Estate Income Tax Certificate California

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

Federal Gift Tax Vs California Inheritance Tax

A Snapshot Of California S Estate Tax Britton Law Group Los Angeles

California Estate Planning Tax Cunninghamlegal

Estate And Gift Tax Archives Werner Law Firm

Coast Litigation Current Estate Taxes And How They Can Change With This Election

Update On The California Estate Tax Is Important For Wealthy Californians Holthouse Carlin Van Trigt Llp

Inheritance Tax Archives South Bay Elder Law

Inheritance Tax What It Is How It S Calculated And Who Pays It

Taxes On Your Inheritance In California Albertson Davidson Llp

Inheritance Tax On House California How Much To Pay And How To Avoid It

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Will My Heirs Be Forced To Pay An Inheritance Tax In California